DWC’s Steve Carver Featured in COCPA Magazine

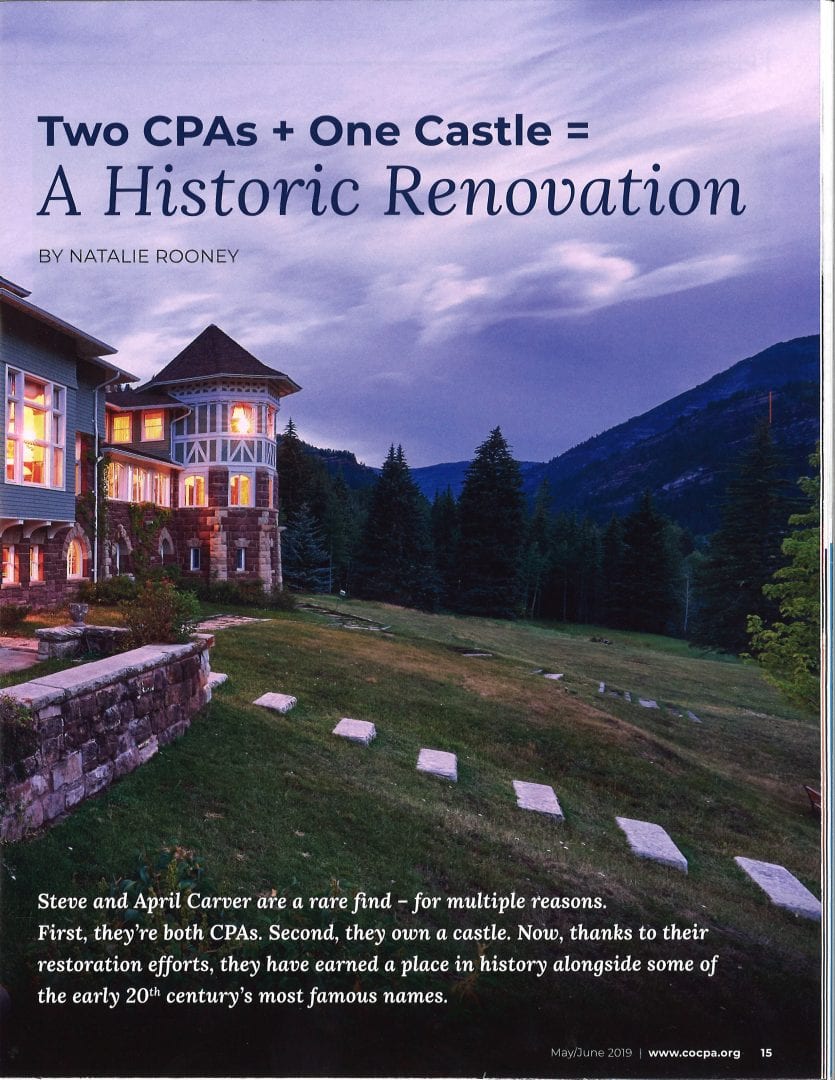

DWC was honored to hear our very own Steve Carver and his wife April were featured in the May/June 2019, NewsAccount magazine article published by the Colorado Society of Certified Public Accountants (COCPA). The article highlights Steve and April's recent business venture in purchasing and restoring the Redstone Castle in