Blog

Tax Benefits and Pitfalls of Turning Your Home Into a Rental Property

In some cases, homeowners decide to move to new residences, but keep their present homes and rent them out. If you’re thinking of doing this, you’re probably aware of the financial risks and rewards. However, you also should know that renting out your home carries potential tax benefits and pitfalls.

Tax Breaks for Businesses and Self-Employed Taxpayers

As the 2021 tax filing season progresses, small businesses and self‐employed taxpayers should make certain they are taking advantage of all of the tax deductions and opportunities available to them on their 2021 federal income tax returns. Tax savings increases after‐tax cash flow and can mean greater return on investment

State Pass-Through Entity Tax Elections

More than 20 states now allow pass‐through entities (PTEs) to elect to be taxed at the entity level to help their residents avoid the $10,000 limit on federal itemized deductions for state and local taxes, also known as the “SALT cap.” For PTEs electing into a state PTE tax regime,

Business Meals Deduction for 2022

The federal government is helping to pick up the tab for certain business meals. Under a provision that’s part of one of the COVID-19 relief laws, the usual deduction for 50% of the cost of business meals is doubled to 100% for food and beverages provided by restaurants in 2022

Tax Implications of Selling Mutual Fund Shares

If you’re an investor in mutual funds or you’re interested in putting some money into them, you’re not alone. According to the Investment Company Institute, a survey found 58.7 million households owned mutual funds in mid-2020. But despite their popularity, the tax rules involved in selling mutual fund shares can

Cash vs. Accrual Accounting Methods

Small businesses may start off using the cash-basis method of accounting. But many eventually convert to accrual-basis reporting to conform with U.S. Generally Accepted Accounting Principles (GAAP). Which method is right for you? Cash Method Under the cash method, companies recognize revenue as customers pay invoices and expenses when they

A Beneficiary Designation or Joint Title Can Override Your Will

Inattention to beneficiary designations and jointly titled assets can quickly unravel your estate plan. Suppose, for example, that your will provides for all of your property to be divided equally among your three children. But what if your IRA, which names the oldest child as beneficiary, accounts for half of

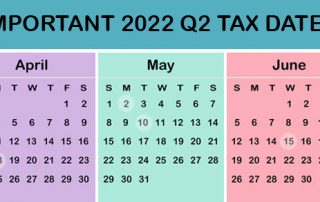

Q2 2022 Tax Deadlines

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to

Tax Rules of Renting Out a Vacation Property

Summer is just around the corner. If you’re fortunate enough to own a vacation home, you may wonder about the tax consequences of renting it out for part of the year. Number of Days Rented and Personal Use The tax treatment depends on how many days it’s rented and your

Establish a Tax-Favored Retirement Plan

If your business doesn’t already have a retirement plan, now might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions. For example, if you’re self-employed and set up a SEP-IRA, you can contribute up to 20% of your self-employment earnings, with a