Blog

QuickBooks Tutorial Videos

QuickBooks provides many helpful and short "how to" videos for users of their accounting software. Click on these QuickBooks tutorial links to watch. How to Collect & Record Sales Tax How to Track & Pay Sales Tax How to Set Up Sales Tax How to Send Estimates, Quotes & Proposals

New Per Diem Rates

In Notice 2020-71, the IRS recently announced per diem rates that can be used to substantiate the amount of business expenses incurred for travel away from home on or after October 1, 2020. Employers using these rates to set per diem allowances can treat the amount of certain categories of

Attn Banks: How to Report COVID-19-Related Debt Restructuring

Today, many banks are working with struggling borrowers on loan modifications. Recent guidance from the Financial Accounting Standards Board (FASB) confirms that short-term modifications due to the COVID-19 pandemic won’t be subject to the complex accounting rules for troubled debt restructurings (TDRs). Here are the details. Accounting for TDRs Under

Can homebuyers deduct seller-paid points?

The housing market is hot right now, despite the ongoing coronavirus pandemic. In fact, the National Association of Realtors (NAR) reports that existing home sales and prices are up nationwide, compared with last year. A sizeable shift in remote work ability and some looking to move to less densely populated

Why You Should Have a Buy-Sell Agreement

Do you own a business with one or more individuals? Undoubtedly, your interest in the business represents a substantial part of your net worth and is likely your “pride and joy.” So it’s normal if your fondest wish is for the business to continue long after you’re gone or for

Bonus Depreciation Key Points

Under current law, 100% bonus depreciation will be phased out in steps for property placed in service in calendar years 2023 through 2027. Thus, an 80% rate will apply to property placed in service in 2023, 60% in 2024, 40% in 2025, and 20% in 2026, and a 0% rate

Reporting Discontinued Operations and Disclosures

Marketplace changes during the COVID-19 crisis have caused many companies to make major strategic shifts in their operations — and some changes are expected to be permanent. In certain cases, these pivot strategies may need to be reported under the complex discontinued operations rules under U.S. Generally Accepted Accounting Principles.

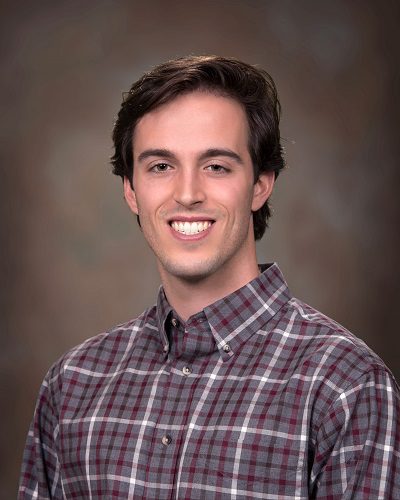

DWC’s Aaron J. May Earns CPA Designation

Dalby, Wendland & Co., P.C., (DWC) is pleased to announce Aaron J. May recently attained the Certified Public Accountant (CPA) designation after passing the Uniform Certified Public Accountant Examination, which is set by the American Institute of Certified Public Accountants. The Uniform CPA Examination protects the public interest by helping

DWC’s Denise Distel Receives QuickBooks Online Advanced Certification

Dalby, Wendland & Co., P.C., (DWC) is pleased to announce Bookkeeper Denise Distel recently attained designation as a QuickBooks Online Advanced Certified ProAdvisor. The QuickBooks Online Advanced Certification is a coveted certification for ProAdvisors who are looking to distinguish themselves to help solve complex problems for their clients, including advanced

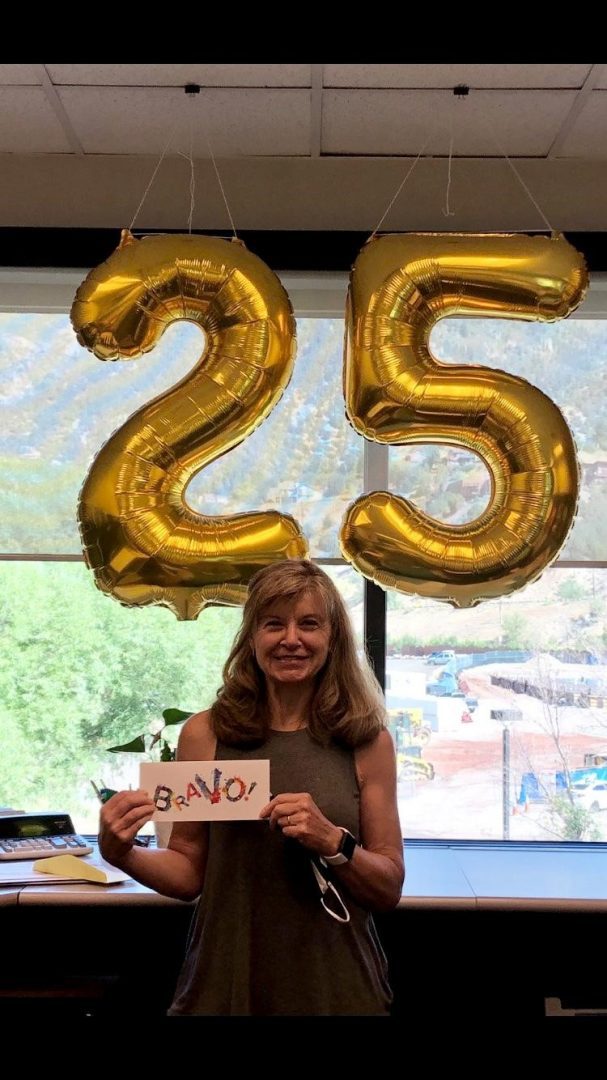

Happy 25 Year Work Anniversary!

Happy Work Anniversary to Elaine DuBois! Elaine has been with our Glenwood Springs office for 25 years – WOW! For her years of service, Elaine gets a travel voucher to relax and enjoy time away. Congratulations – we are so fortunate to have you with us!