Blog

Do you have an emergency succession plan?

For business owners, succession planning is ideally a long-term project. You want to begin laying out a smooth ownership transition, and perhaps grooming a successor, years in advance. And you shouldn’t officially hand over the reins until many minute details have been checked and rechecked. Unfortunately, things don't always work

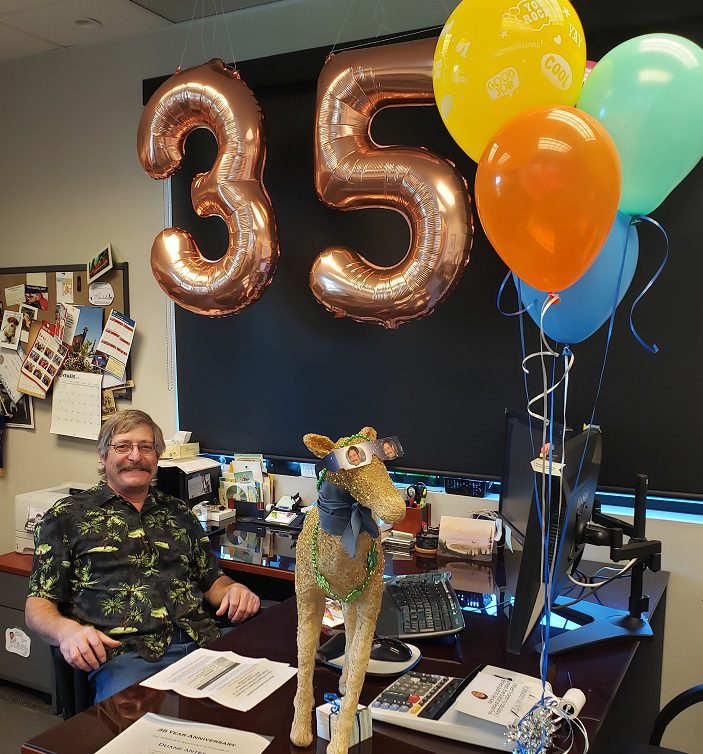

Happy Work Anniversary to Duane Antes!

DWC wishes to congratulate and thank Duane Antes for 35-years of serving our clients! Duane is a principal and shareholder in our Glenwood Springs office. We truly appreciate the fun and laughs he brings to our team. There's never a dull moment with Duane, especially during "kid" season (Duane and

SBA Releases New and Revised PPP Loan Forgiveness Applications

The SBA just released a revised PPP Loan Forgiveness Application and a new EZ Loan Forgiveness Application for borrowers. The revised form includes the changes from the Paycheck Protection Program Flexibility Act of 2020 that was signed into law on June 5th. The new EZ form has fewer calculation requirements

Streamline Your Month-End Close

Many companies struggle to close the books at the end of the month. It requires accounting personnel to round up data from across the organization. Under normal conditions, this process can strain internal resources. However, in recent years the accounting and tax rules have undergone major changes — many of

New OSHA Guidance on Tracking COVID-19 at Work

Until recently, employers in only a handful of industries had to provide significant reporting on COVID-19 transmission in the workplace. But as of May 26, new Occupational Safety and Health Administration guidelines require a much wider range of employers to determine whether employees caught the coronavirus at work or while

Business Meal and Entertainment Deductions

Restaurants and entertainment venues have been hard hit by the novel coronavirus (COVID-19) pandemic. One of the tax breaks that President Trump has proposed to help them is an increase in the amount that can be deducted for business meals and entertainment. It’s unclear whether Congress would go along with

Paycheck Protection Program Flexibility Act of 2020 (PPPFA) Summary

Businesses, employers, and SBA lenders have been waiting for further clarification and added relief regarding the SBA Paycheck Protection Program (PPP). The new Paycheck Protection Program Flexibility Act of 2020 (PPPFA) provides some of the much needed guidance. Here is a summary of the bill. These provisions are retroactive to

Businesses Modify Employee Sales Comp Models for Pandemic

Economists will look back on 2020 as a year with a distinct before and after. In early March, most companies’ sales projections looked a certain way. Just a few weeks later, those projections had changed significantly — and not for the better. Because of the novel coronavirus (COVID-19) pandemic, businesses

FASB Gives More Time for Updated Revenue Recognition and Leases

Private companies and most nonprofits were supposed to implement updated revenue recognition guidance in fiscal year 2019 and updated lease guidance in fiscal year 2021. In the midst of the novel coronavirus (COVID-19) crisis, the Financial Accounting Standards Board (FASB) has decided to give certain entities an extra year to

Spousal Lifetime Access Trust Can Provide Financial Backup Plan

Some of the most effective estate planning strategies involve setting up irrevocable trusts. For a trust to be deemed irrevocable, you, the grantor, lose all incidents of ownership of the trust’s assets. In other words, you’re effectively removing those assets from your taxable estate. But what if you’re uncomfortable placing