Blog

CARES Act – Employee Retention Tax Credit

The recently enacted Coronavirus Aid, Relief, and Economic Security (CARES) Act provides a refundable payroll tax credit for 50% of wages paid by eligible employers to certain employees during the COVID-19 pandemic. The employee retention tax credit is available to employers, including nonprofit organizations, with operations that have been fully

CARES Act: Retirement Plan and Charitable Contribution Rule Changes

The Coronavirus Aid, Relief, and Economic Security (CARES) Act contains a variety of relief, notably the “economic impact payments” that will be made to people under a certain income threshold. But the law also makes some changes to retirement plan rules and provides a new tax break for some people

CARES Act Stimulus Payments to Individuals

A new law signed by President Trump on March 27 provides a variety of tax and financial relief measures to help Americans during the coronavirus (COVID-19) pandemic. This article explains some of the tax relief for individuals in the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Individual Cash Payments

Business and Employer Resources for Coronavirus

DWC has created a resources page to help businesses and employers navigate coronavirus news and updates regarding tax deadlines and payment extensions, federal and state relief provisions, and disaster loan assistance. We continue to update the page as information becomes available. Click HERE or find on our website under the

Warning – Another SCAM Alert Related to the CARES Act Stimulus Payments

Scammers are already using fraudulent methods to attain your personal information with the CARES relief payment issuance to individuals. Because many of these stimulus payments are to be issued by direct deposit, scammers are “phishing” by phone calls, text messages, or emails to pretend to verify your banking information. The

Colorado Stay at Home Order – DWC Business Continuity

With Colorado Governor Polis issuing a Stay at Home Order for “non-essential” businesses, we wanted to let you know that all of our offices are honoring the Order. Even though our industry does not fall into the “non-essential” category, the health and safety of our staff, families, clients, and community

Coronavirus May Affect Financial Reporting

The coronavirus (COVID-19) outbreak — officially a pandemic as of March 11 — has prompted global health concerns. But you also may be worried about how it will affect your business and its financial statements for 2019 and beyond. Close up on financial reporting The duration and full effects of the COVID-19

Updated Guidance from IRS, Treasury Dept., and State of Colorado

The Treasury Department and the Internal Revenue Service issued IRS Notice 2020-18, providing guidance on both filing and payment relief. Here is the latest: TAX DEADLINES EXTENDED The new Notice postpones both the filing and payment deadline to July 15, 2020, for income tax returns and income tax payments normally

DWC Readiness to COVID-19

Our number one priority is the safety of our staff, families, clients, and community. DWC Leadership is closely monitoring national, state, and local recommendations and response to the new coronavirus (COVID-19) to ensure we have the most updated and correct information, and to do our part in keeping our clients,

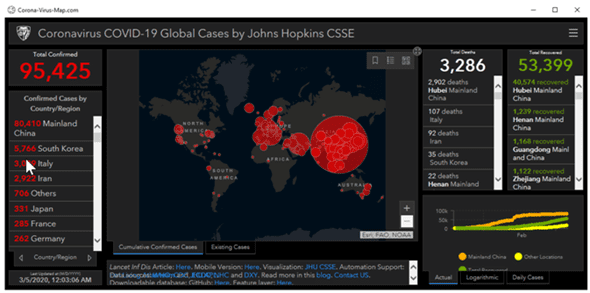

BEWARE: Coronavirus Map Malware Scam

As our nation and other countries respond to the new coronavirus (COVID-19) fraudsters are finding ways to play on fear and uncertainty. It is important to remain vigilant regarding protecting your personal information. Beware of a current scam whereby criminals are leveraging the COVID-19 epidemic to spread malware through a