Blog

Standard Mileage Rates for 2020

The IRS announced the 2020 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. Beginning on Jan. 1, 2020, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 57.5

Estates: IRS Confirms Large Gifts Now Won’t Hurt Post 2025

The IRS has issued final regulations that should provide comfort to taxpayers interested in making large gifts under the current gift and estate tax regime. The final regs generally adopt, with some revisions, proposed regs that the IRS released in November 2018. Providing clarification The Tax Cuts and Jobs Act

DWC’s Paige Curtiss Attains CPA Designation

Dalby, Wendland & Co., P.C., is pleased to announce Paige A. Curtiss recently attained the Certified Public Accountant (CPA) designation after passing the Uniform Certified Public Accountant Examination, which is set by the American Institute of Certified Public Accountants. The Uniform CPA Examination protects the public interest by helping to

Tax Law Changes – Further Consolidated Appropriations Act

Highlights of the Further Consolidated Appropriations Act, 2020 The federal government spending package titled the Further Consolidated Appropriations Act, 2020, does more than just fund the government. It extends certain income tax provisions that had already expired or that were due to expire at the end of 2019. The agreement

Manage Your Working Capital

Working capital is calculated as the difference between a company’s current assets and current liabilities. For a business to thrive, working capital must be greater than zero. A positive balance enables the company to meet its short-term cash flow needs and grow. And, too much working capital can be a

Taxpayer Filing Status

For tax purposes, December 31 is more than New Year’s Eve celebrations. It affects the filing status box that will be checked on your tax return for the year. When you file your return, you do so with one of five filing statuses, which depend in part on whether you’re

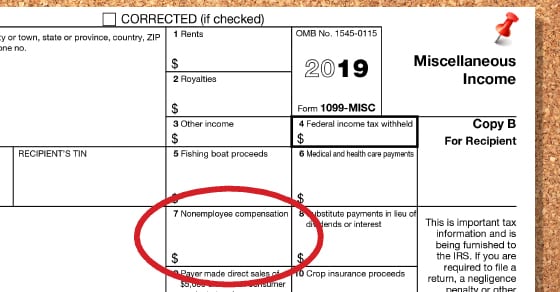

Small Business 1099-MISC Reporting Requirements

Your business may be required to comply with rules to report amounts paid to independent contractors, vendors and others. You may have to send 1099-MISC forms to those whom you pay nonemployee compensation, as well as file copies with the IRS. This task can be time consuming and there are

Tax Break Rules for Company Holiday Parties and Gifts

With Thanksgiving behind us, the holiday season is in full swing. At this time of year, your business may want to show its gratitude to employees and customers by giving them gifts or hosting holiday parties. It’s a good idea to understand the tax rules associated with these expenses. Are

Year-End Tax-Saving Tools for Your Business

At this time of year, many business owners ask if there’s anything they can do to save tax for the year. Under current tax law, there are two valuable depreciation-related tax breaks that may help your business reduce its 2019 tax liability. To benefit from these deductions, you must buy

Switching from a C to S Corporation

The right entity choice can make a difference in the tax bill you owe for your business. Although S corporations can provide substantial tax advantages over C corporations in some circumstances, there are plenty of potentially expensive tax problems that you should assess before making the decision to convert from