Blog

DWC’s Steve Carver Featured in COCPA Magazine

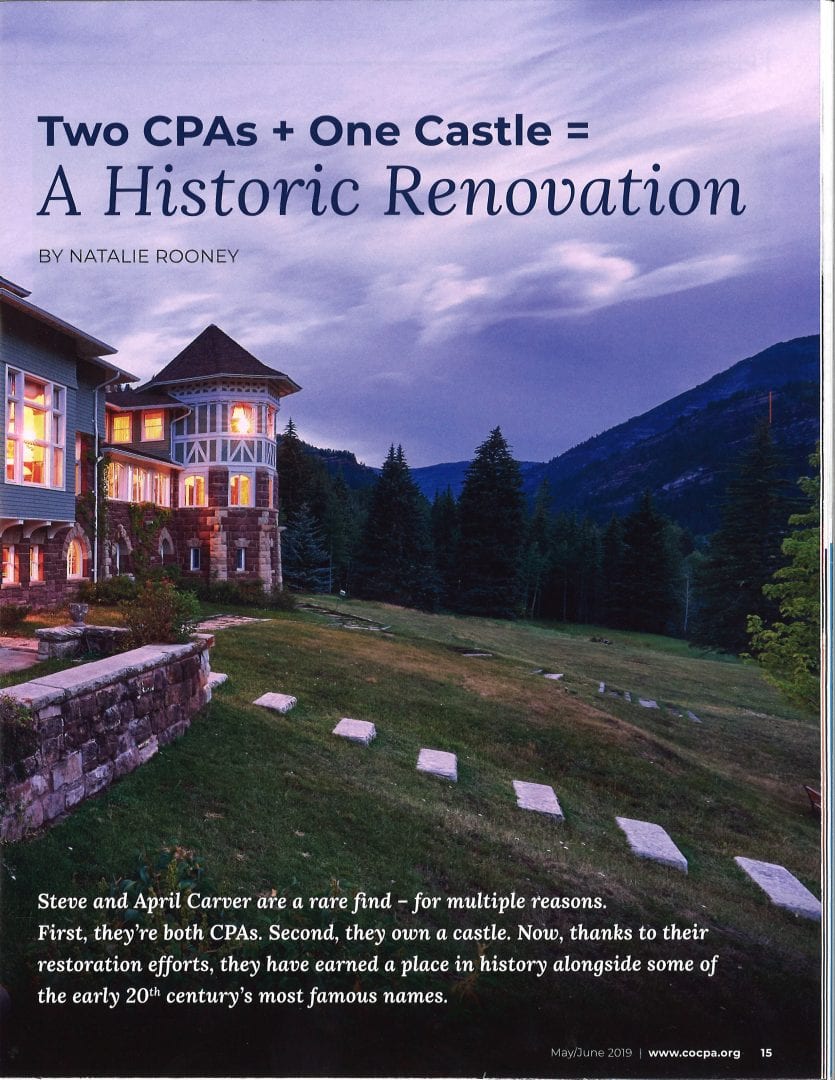

DWC was honored to hear our very own Steve Carver and his wife April were featured in the May/June 2019, NewsAccount magazine article published by the Colorado Society of Certified Public Accountants (COCPA). The article highlights Steve and April's recent business venture in purchasing and restoring the Redstone Castle in

Deducting Business Start-Up Expenses

Have you recently started a new business or are thinking of starting one? A new venture is exciting and as you know, you generally have to spend a lot of money just to open the doors. Expenses may include training workers, rent, utilities, IT, marketing, and more. Many new business

Tax Savings for Electric Vehicles

While the number of plug-in electric vehicles (EVs) is still small compared with other cars on the road, it’s growing — especially in certain parts of the country. If you’re interested in purchasing an electric or hybrid vehicle, you may be eligible for a federal income tax credit of up

Estate Planning for Single Parents

According to Pew Research Center’s most recent poll, the percentage of U.S. children who live with an unmarried parent has jumped from 13% in 1968 to 32% in 2017. While estate planning for single parents is similar to estate planning for families with two parents, when only one parent is

Have a Business Turnaround Strategy

Many businesses have a life cycle that, as life cycles tend to do, concludes with a period of decline and failure. Often, the demise of a company is driven by internal factors — such as weak financial oversight, lack of management consensus or one-person rule. External factors typically contribute, as

Help Your Grandkids With College Financing

The staggering cost of college makes it critical for families to plan carefully for this major expense, and in many cases grandparents want to play a role. As you examine the many financing options for your grandchildren, be sure to consider their impact on your estate plan. Make direct payments

Why CPA Designation Matters

The accounting profession is largely self-regulated by the American Institute of Certified Public Accountants (AICPA). Part of its mission involves the development and enforcement of a broad range of standards for the profession. There is no requirement that you have to be a licensed Certified Public Accountant (CPA) to do

Dalby Wendland Names Chris West as CEO

Christopher L. West, CPA Dalby, Wendland & Co., P.C., is pleased to announce the election of Christopher L. West, CPA, as the firm’s Chief Executive Officer (CEO), effective July 1, 2019. “We are positioning Dalby Wendland for a dynamic future,” says Firm President Greg Keller. “Chris has shown

Add Spendthrift Language to Your Trust

Protecting assets from creditors is a critical aspect of estate planning, but you need to think about more than just your own creditors. You also need to consider your heirs’ creditors. Adding spendthrift language to a trust benefiting your heirs can help safeguard assets. Spendthrift language explained Despite its name,

Donating Valuable Art

Charitable giving is a key part of estate planning for many people. If you have a collection of valuable art and are charitably minded, consider donating one or more pieces to receive tax deductions. Generally, it’s advantageous to donate appreciated property to avoid capital gains taxes. Because the top federal