Blog

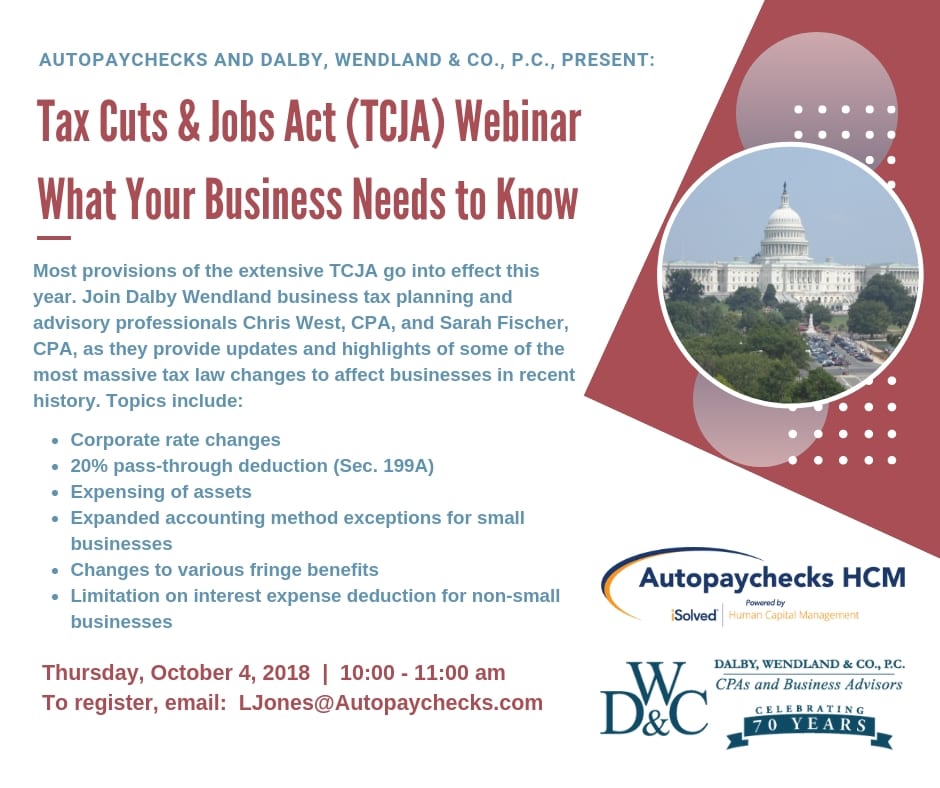

Tax Cuts & Jobs Act (TCJA) Updates Webinar for Businesses

Most provisions of the extensive Tax Cuts & Jobs Act (TCJA) go into effect this year. Join Dalby Wendland business tax planning and advisory professionals Chris West, CPA, and Sarah Fischer, CPA, as they provide updates and highlights of some of the most massive tax law changes to affect businesses

Taxes and Gambling Wins or Losses

If you gamble, be sure you understand the tax consequences. Both wins and losses can affect your income tax bill. And changes under the Tax Cuts and Jobs Act (TCJA) could also have an impact. Wins and taxable income You must report 100% of your gambling winnings as taxable income.

2018 Q4 Tax-Related Deadlines for Businesses

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2018. Keep in mind that this list isn’t all-inclusive, so there may be additional tax deadlines for businesses that apply to you. Contact us to ensure you’re meeting all applicable deadlines

Dalby Wendland in Top 300 Public Accounting Firms

Dalby, Wendland & Co., P.C., is honored to be recognized by INSIDE Public Accounting (IPA) as a Top 300 Firm. IPA 300 firms are ranked by U.S. net revenues and are compiled by analyzing more than 550 responses to IPA’s Survey and Analysis of Firms. This is Dalby, Wendland &

Consider Tax-Qualified Long-Term Care Insurance

No matter how diligently you prepare, your estate plan can quickly be derailed if you or a loved one requires long-term home health care or an extended stay at a nursing home or assisted living facility. The annual cost of long-term care (LTC) can reach as high as six figures,

Assessing the S Corp Business Structure

The S corporation business structure offers many advantages, including limited liability for owners and no double taxation (at least at the federal level). But not all businesses are eligible - and, with the new 21% flat income tax rate that now applies to C corporations, S corps may not be

Special Needs Trust for Family Members with Special Needs

If you have a child or other family member with a disabling condition that requires long-term care or prevents (or will prevent) him or her from being able to support him- or herself, consider establishing a special needs trust (SNT). Also known as a supplemental needs trust, an SNT allows

Family Business Succession and FLPs

One of the biggest concerns for family business owners is succession planning — transferring ownership and control of the company to the next generation. Often, the best time tax-wise to start transferring ownership is long before the owner is ready to give up control of the business. A family limited

Auditing the Use of Estimates and Specialists

Complex accounting estimates — such as allowances for doubtful accounts, impairments of long-lived assets, and valuations of financial and nonfinancial assets — have been blamed for many high-profile accounting scams and financial restatements. Estimates generally involve some level of measurement uncertainty, and some may even require the use of outside

Charitable Gift Annuity for Income Stream and Tax Deduction

If you’re charitably inclined, you may wish to consider a charitable gift annuity. It can combine the benefits of an immediate income tax deduction and a lifetime income stream. Furthermore, it allows you to support a favorite charity and reduce the size of your future taxable estate. What is it?