Blog

Saving Tax with Home-Related Deductions and Exclusions

Currently, home ownership comes with many tax-saving opportunities. Consider both deductions and exclusions for tax planning in 2017 and if you have not filed your 2016 return yet: Property tax deduction. Property tax is generally fully deductible — unless you’re subject to the alternative minimum tax (AMT). Mortgage interest deduction.

2017 Q2 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the second quarter of 2017. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more

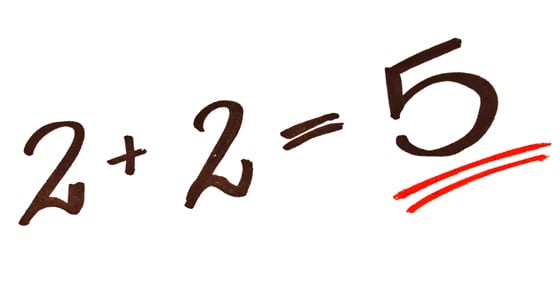

Financial Statement Fraud – Cooking the Books

What’s the most costly type of white collar crime? On average, a company is likely to lose more money from a scheme in which the financial statements are falsified or manipulated than from any other type of occupational fraud incident. The costs frequently include more than just the loss of

Are You Leaving Your IRA to Someone Other Than Your Spouse?

An IRA can be a powerful wealth-building tool, offering tax-deferred growth (tax-free in the case of a Roth IRA), asset protection and other benefits. But if you leave an IRA to your children — or to someone else other than your spouse — these benefits can be lost without careful

5 Accounting Mistakes Your Nonprofit Should Avoid

To err is human, but your not-for-profit’s supporters, not to mention the IRS, may be less than forgiving if errors affect your financial books. Fortunately, if you attend to accounting details, you can avoid these common pitfalls: 1. Failing to follow accounting procedures. Even the smallest nonprofit should set formal,

Key Deadlines for the Remainder of 2017 for Individuals

While April 15 (April 18 this year) is the main tax deadline on most individual taxpayers’ minds, there are others through the rest of the year that are important to be aware of. To help you make sure you don’t miss any important 2017 deadlines, here’s a look at when

Offer Retirement Plan Loans? Be Sure to Set a Reasonable Interest Rate

Like many businesses, yours may allow retirement plan participants to take out loans from their accounts. Such loans are governed by many IRS and Department of Labor (DOL) rules and regulations. So if your company offers plan loans, your plan document must comply with current laws — including setting a

How a Deductible Home Office Affects a Sale

If you use part of your home as an office and take deductions for related expenses on your annual tax return, can you claim a valuable federal tax break when you sell? Specifically, can you claim the home sale gain exclusion of up to $250,000 for single taxpayers ($500,000 for married

Remember RMDs This Tax Season

Did you know that, once you turn age 70½, you must start taking mandatory annual withdrawals from your traditional IRAs, including any simplified employee pension (SEP) accounts and SIMPLE IRAs that you set up as a small business owner? These mandatory IRA payouts are called required minimum distributions (RMDs). And

Does your nonprofit need to register in multiple states?

If your not-for-profit solicits funds online — or uses other fundraising methods that cross state boundaries — it may need to register in multiple jurisdictions. We’ve answered some commonly asked questions. My charity receives occasional contributions from out-of-state donors. Do I need to register with those states? Yes, but only