Blog

Align Your Will With Other Documents

You know the importance of having a will. If you die "intestate" (in other words, without a will), your state's laws will determine the disposition of your assets. Your actual wishes will be irrelevant, even though they may be well-known to your friends and relatives. But even if you do

Remember RMDs This Tax Season

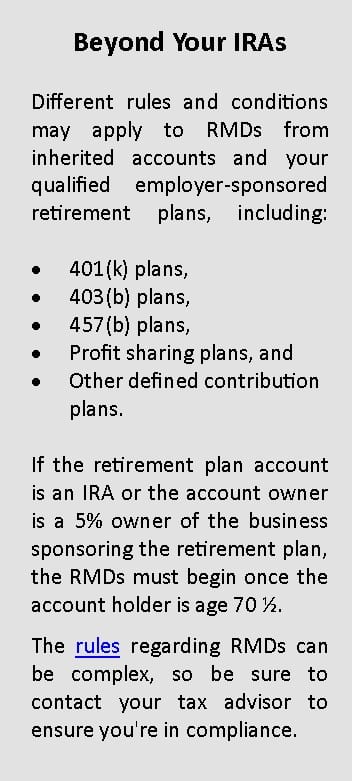

Did you know that, once you turn age 70½, you must start taking mandatory annual withdrawals from your traditional IRAs, including any simplified employee pension (SEP) accounts and SIMPLE IRAs that you set up as a small business owner? These mandatory IRA payouts are called required minimum distributions (RMDs). And

How Entity Type Affects Tax Planning for Owner-Employees

Come tax time, owner-employees face a variety of distinctive tax planning challenges, depending on whether their business is structured as a partnership, limited liability company (LLC) or corporation. Whether you’re thinking about your 2016 filing or planning for 2017, it’s important to be aware of the challenges that apply to

SEPs: A Powerful Retroactive Tax Planning Tool

Simplified Employee Pensions (SEPs) are sometimes regarded as the “no-brainer” first choice for high-income small-business owners who don’t currently have tax-advantaged retirement plans set up for themselves. Why? Unlike other types of retirement plans, a SEP is easy to establish and a powerful retroactive tax planning tool: The deadline for

DWC CPAs Earn Exclusive Credentials as Business Valuation Experts

Dalby, Wendland & Co., P.C., is pleased to announce accountants Nathan (“Nate”) A. Fyock, CPA, ABV, and Donna M. Hardy, CPA, CVA, have attained certified business valuation credentials. Fyock has been awarded the Accredited in Business Valuation (ABV) credential by the American Institute of Certified Public Accountants (AICPA). Hardy received

Tips for Efficient Year-End Physical Inventory Counts

Do you dread the year-end physical inventory count? Business owners and managers often view these procedures as time consuming and disruptive. But a well-executed inventory count is more than a matter of compliance. It can also provide valuable insight into improving operational efficiency. Here’s how to run your count to

Take Small-Business Tax Credits Where Credits are Due

Tax credits reduce tax liability dollar-for-dollar, making them particularly valuable. Two available credits are especially for small businesses that provide certain employee benefits. And one of them might not be available after 2017. 1. Small-business health care credit The Affordable Care Act (ACA) offers a credit to certain small employers

2016 Higher-Education Breaks Can Save Your Family Taxes

Was a college student in your family last year? Or were you a student yourself? You may be eligible for some valuable tax breaks on your 2016 return. To max out your higher education breaks, you need to see which ones you’re eligible for and then claim the one(s) that

Why 2016 May be an Especially Good Year to Take Bonus Depreciation

Bonus depreciation allows businesses to recover the costs of depreciable property more quickly by claiming additional first-year depreciation for qualified assets. The PATH Act, signed into law a little over a year ago, extended 50% bonus depreciation through 2017. Claiming this break is generally beneficial, though in some cases a

Sorting Through the “Levels of Assurance” in Financial Reporting

How confident (or assured) are you that your financial reports are reliable, timely and relevant? In order of increasing level of rigor, accountants generally offer three types of assurance services: compilations, reviews and audits. What’s appropriate for your company depends on the needs of creditors or investors, as well as