Blog

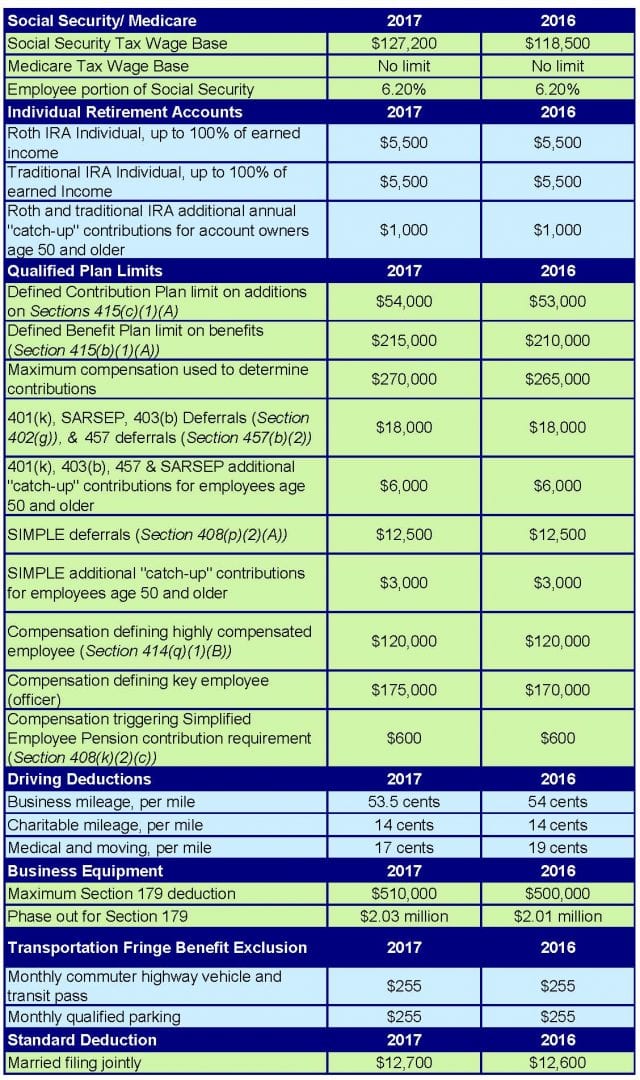

Important Tax Figures for 2017

The following table provides some important federal tax information for 2017, as compared with 2016. Many of the dollar amounts are unchanged or have changed only slightly due to low inflation. Other amounts are changing due to legislation.

Are You Able to Deduct Medical Expenses on Your Tax Return?

For many people, the cost of medical care keeps going up. So if possible, you should find ways to claim tax breaks related to health care. Unfortunately, it can be difficult because there’s a threshold for deducting itemized medical expenses that can be tough to meet. To make matters worse,

Are You Ready for Audit Season?

It’s almost audit season for calendar-year entities. A little preparation can go a long way toward facilitating the external audit process, minimizing audit adjustments and surprises, lowering your audit fees in the future and getting more value out of the audit process. Here are some ways to plan ahead. The

Parent Mental Incapacitation and Financial Matters

If your elderly parent’s mental state is deteriorating to the point where he or she is unable to manage day-to-day activities, it may be time to make the difficult decision to have him or her declared incapacitated. But how do you know if such action is necessary? 2 key questions

2017 Q1 Tax Calendar: Key Deadlines for Businesses and Other Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2017. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more

Family Matters: Stepchildren and Your Estate Plan

If you have unadopted stepchildren, estate planning is critical to ensure that your property is distributed the way you desire. Stepchildren generally don’t have any inheritance rights with respect to their parents’ new spouses unless the spouse legally adopts them. If you have stepchildren and want them to share in

Your Company’s Balance Sheet Makes Great Reading This Time of Year

Year end is just about here. You know what that means, right? It’s a great time to settle in by a roaring fire and catch up on reading … your company’s financial statements. One chapter worth a careful perusal is the balance sheet. Therein may lie some important lessons. 3

Accelerating Your Property Tax Deduction to Reduce Your 2016 Tax Bill

Smart timing of deductible expenses can reduce your tax liability, and poor timing can unnecessarily increase it. When you don’t expect to be subject to the alternative minimum tax (AMT) in the current year, accelerating deductible expenses into the current year typically is a good idea. Why? Because it will

Reporting UTPs

Navigating the tax code — and staying atop the latest tax law developments — can be challenging for business owners. In turn, financial reporting for uncertain tax positions (UTPs), such as pending IRS audits or lawsuits, is complicated and subjective. Here’s some guidance to help clarify matters. Applying the threshold

Help Prevent the Year-End Vacation-Time Scramble With a PTO Contribution Arrangement

Many businesses find themselves short-staffed from Thanksgiving through December 31 as employees take time off to spend with family and friends. But if you limit how many vacation days employees can roll over to the new year, you might find your workplace a ghost town as workers scramble to use,