Blog

It’s Sometimes Hard to Report “Hard” Assets

How much do you really know about accounting for property, plant and equipment? U.S. Generally Accepted Accounting Principles (GAAP) permits some leeway when deciding whether to capitalize or expense a fixed asset purchase, as well as in choosing depreciation methods and useful lives. Such leeway is part of the reason

Transfer a Family Business in a Tax-Smart Way

Is a family-owned business your primary source of wealth? If so, it’s critical to plan carefully for the transition of ownership from one generation to the next. The best approach depends on your particular circumstances. If your net worth is well within the estate tax exemption, you might focus on

Thinking Big is the First Step Toward Growing Your Business

Nearly every business owner wants to grow his or her company. But with growth comes risk, and that can keep you from taking the steps necessary to move forward. Yet if you don’t think big and come up with a long-term strategic plan, you’ll likely continue to spin your wheels.

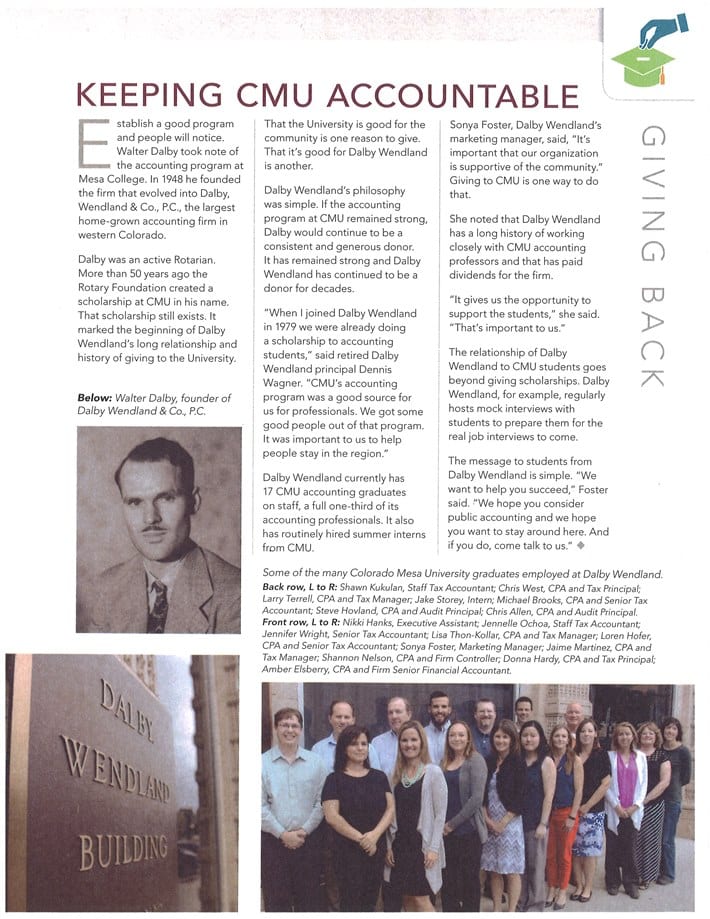

Decades of Supporting Future Accounting Professionals

Supporting the future of accounting professionals has been a core tenet for Dalby, Wendland & Co., P.C. The many exceptional higher educational institutions in western Colorado gives us the opportunity to make a difference in our communities and our profession. Annually, we visit college campuses to meet students, hear about

Prenups and Estate Plans: Make Sure They Work Together

If you’re getting married, estate planning likely is the last thing you want to think about. But if you and your future spouse plan to sign a prenuptial agreement (commonly referred to as simply a “prenup”), it’s a good idea to design the agreement with your estate plan in mind.

Are You Coordinating Your Income Tax Planning With Your Estate Plan?

Until recently, estate planning strategies typically focused on minimizing federal gift and estate taxes, such as by giving away assets during life to reduce the taxable estate. Today, however, the focus has moved toward income taxes, making the coordination of income tax planning and estate planning more important. Why the

Are You Timing Business Income and Expenses to Your Tax Advantage?

Typically, it’s better to defer tax. One way is through controlling when your business recognizes income and incurs deductible expenses. Here are two timing strategies that can help businesses do this: Defer income to next year. If your business uses the cash method of accounting, you can defer billing for

Have You Provided for the Removal of a Trustee in Your Estate Plan?

When drafting an estate plan, it’s critical to select the right trustee to carry out your wishes and protect your beneficiaries. It’s also important to establish procedures for removing a trustee in the event that circumstances change. Failing to do so doesn’t mean your beneficiaries will be stuck with an

Why Nonprofits Should Be Careful About Doing Business With Board Members

Your not-for-profit’s board members may be able to offer access to better deals or services than your organization could get on its own. However, there’s a fine line between a board member helping your nonprofit get fair pricing and the member receiving perceived or actual personal benefits. The latter can

Time May Be Running Out…Again

Income tax generally applies to all forms of income, including cancellation-of-debt (COD) income. Think of it this way: If a creditor forgives a debt, you avoid the expense of making the payments, which increases your net income. Fortunately, since 2007, homeowners have been allowed to exclude from their taxable income