Blog

Congratulations!

Congratulations to DWC's Dan Arnold (middle in the tux) for receiving the Montrose Chamber's Committee Member of the Year for the Governmental Affairs Council!

Colorado’s New Jump-Start “Tax-Free” Zone Program for Businesses

Kristi Pollard, Executive Director for the Grand Junction Economic Partnership (GJEP), penned a great article in ColoradoBiz on the first-ever Jump-Start “tax-free” zone program to help business startups and expanding businesses with great tax relief for up to eight years. Currently the program is only valid in Mesa County; however,

PATH Act Summary for Businesses and Individuals

Article by Jaime Martinez, CPA Grand Junction Office Just before their holiday break, Congress passed, and President Obama signed, the Protecting Americans from Tax Hikes (PATH) Act of 2015, modifying many of the 50+ tax relief provisions on which businesses and individuals have come to rely. The following is not

Choose Your Tax Preparer Wisely

Tax season is officially here and many people do not realize they are responsible for the information on their tax return – regardless of who prepares it. Be wary of who you choose to prepare your taxes. • Make sure your preparer is truly qualified (e.g., CPA, Enrolled Agent, etc.).

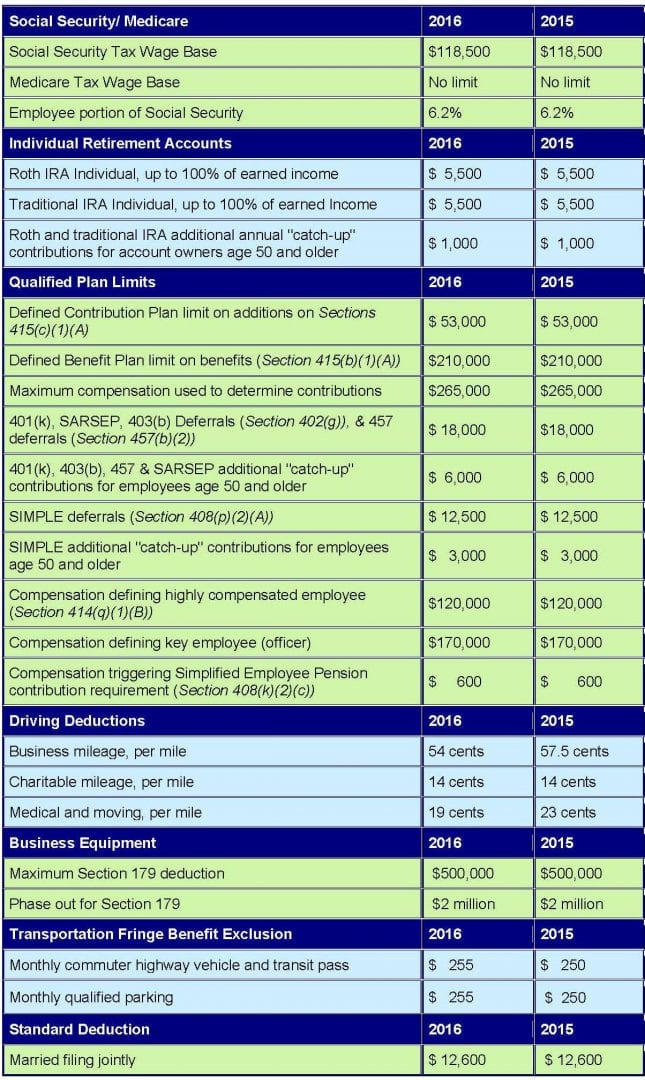

Important Tax Figures for 2016

Every year, the dollar amounts allowed for various federal tax benefits are subject to change based on inflation adjustments and legislation. Here are some important tax figures for 2016, compared with 2015, including the estate tax exemption, Social Security wage base, qualified retirement plan and IRA contribution limits, driving deductions,

PATH Act Provides Tax Relief for 2015 and Beyond

In December the Protecting Americans from Tax Hikes Act of 2015 (PATH Act), was approved. The act extends certain tax relief provisions that expired at the end of 2014. In many cases, it makes the breaks permanent. These provisions can produce significant savings for taxpayers, but some had to be

Happy Holidays!

From our family to yours - Merry Christmas and Happy New Year!

2016 Standard Mileage Rates Announced

Beginning on January 1, 2016, the standard mileage rates for the use of a car, van, pickup, or panel trucks will be: • 54 cents per mile for business miles driven (down from 57.5 cents for 2015) • 19 cents per mile driven for medical or moving purposes (down from

Glenwood Accountants Display Their Holiday Spirit

The Glenwood Springs office held an ugly Christmas sweater/tie contest last week and the group had a lot of fun out-doing each other. The winner, however, was most apparent – James Heelan took first place with his ugly sweater suit. Congrats to